Get started with a free PowerExcel Teams plan.

Start collaborating on your plans and forecasts in Excel. Register now!

Connected planning and forecasting in Excel

Do you need to share numbers more seamlessly with your team?

Are you responsible for communicating and executing leadership’s vision of the business?

Are you looking for a better way to work in Excel?

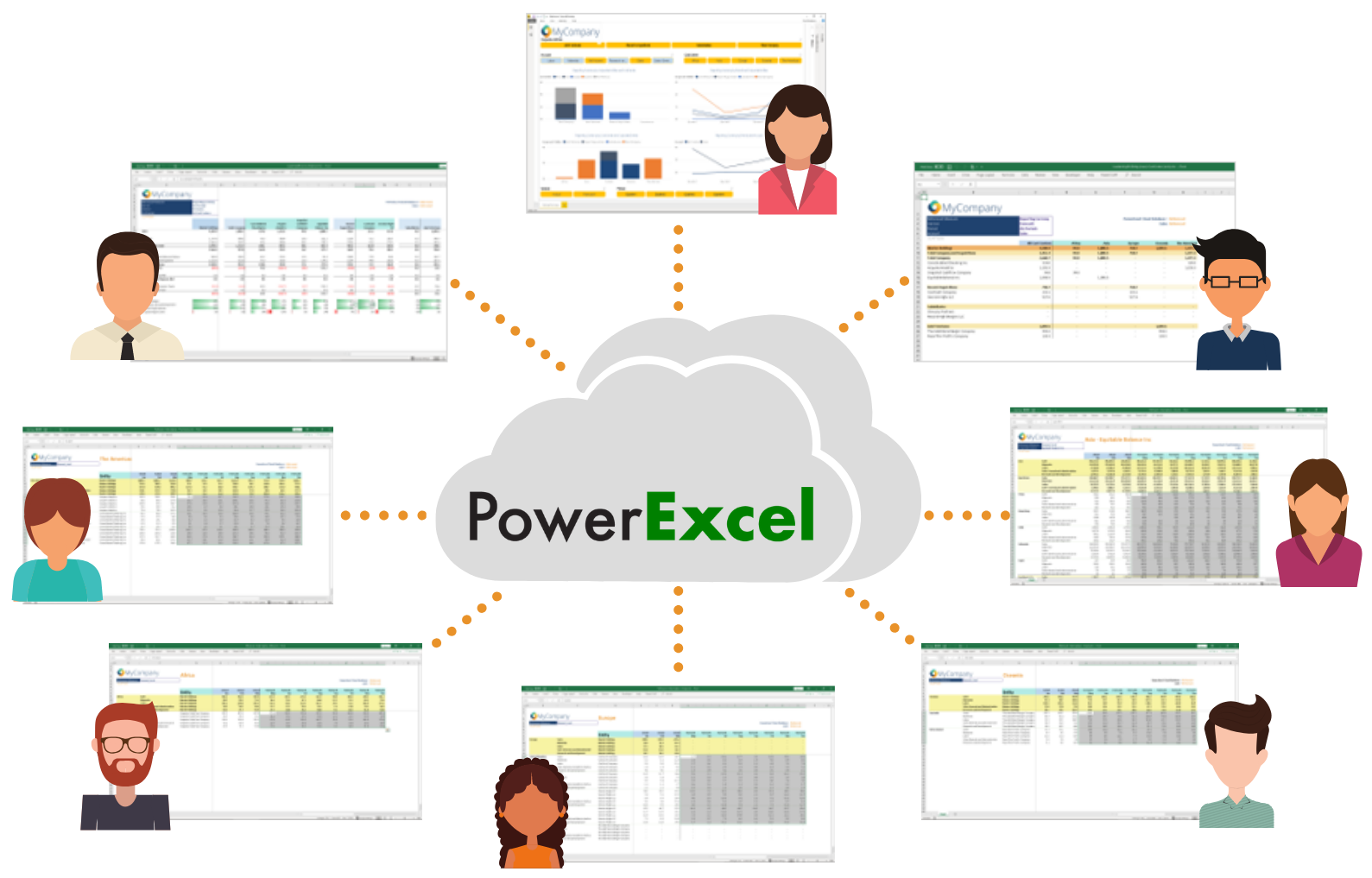

Give your team a way to easily collaborate with dynamic spreadsheets connected through the cloud.

No matter where you are in the world, PowerExcel connects your workbooks so that your people can work as a team, in real-time.

Hello Collaboration

Users press F9 to share their data with one another.

START

- Seamlessly sharing your data through the cloud

- Seeing your numbers tick and tie from the start

- Using a Financial Data Repository that keeps your numbers straight

Goodbye Linked Workbooks

Users edit the same workbook

STOP

- Checking spreadsheet links

- Worrying about how to consolidate your numbers

- Emailing workbooks

- Storing multiple versions on Sharepoint

Excel

+ Shared model

+ calculation Engine

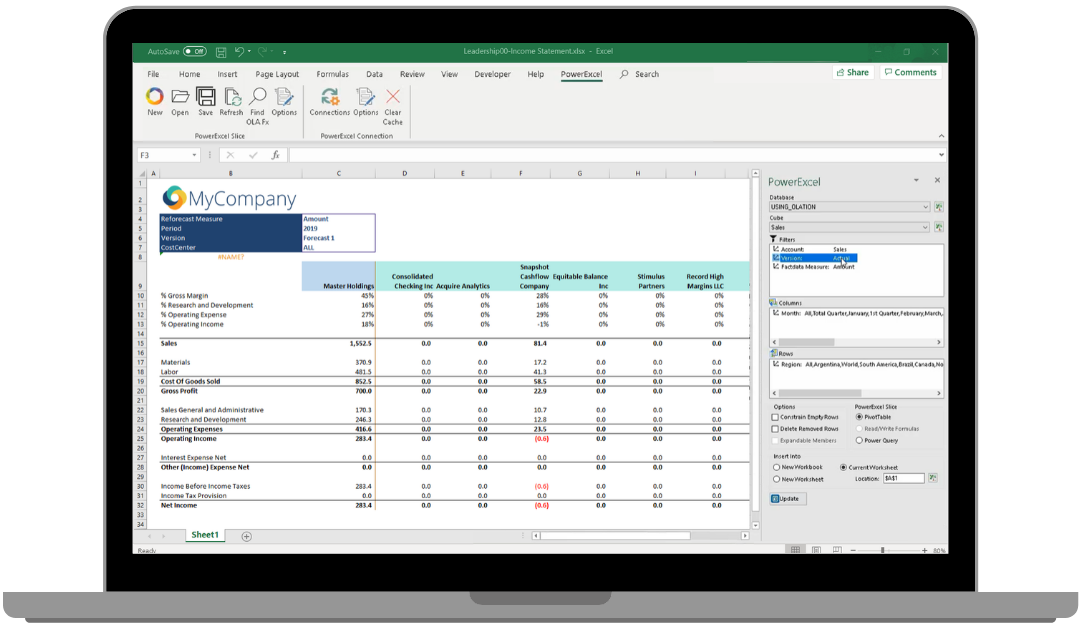

ModeLing capabilities in excel spreadsheets

- Leverage the best of Excel by using spreadsheets as an interface to a central data model

- Move your calculations to a central data model to avoid formula errors

- Define hierarchies to automate roll-ups and consolidations

- Create forecast versions without copying multiple workbooks

- Blend Actuals with Plans and Forecast versions

- Connect your data model to Power BI and other tools for consistent results